delayed draw term loan definition

However they can also be attached to unitranche financing. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction.

. The primary purpose for DDTLs is to fund additional. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times.

Delayed Draw T-2 Loans borrowed and repaid or prepaid may not be reborrowed. Examples of Delayed Draw T-2 Loans in a sentence. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times.

Understanding Delayed Draw Term Loans. A special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. FinanceA special feature in.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. A draw period is the amount of time you have to withdraw funds. A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives.

Examples of Delayed Draw Term Loan in a sentence. A loan feature that lets the borrower withdraw amounts at predefined times. At the time of and immediately after giving effect to such Borrowing of Delayed Draw T-2 Loans no Default shall have occurred and be continuing.

The withdrawal periodssuch as every three six or nine monthsare also unwavering in advance. A delayed draw term loan DDTL is a special feature in a term loan that disillusion admits a borrower withdraw predefined amounts of a total pre-approved loan amount. Delayed Draw Term Loan Definition Investopedia.

With a DDTL you can withdraw funds several times from a predetermined loan amount. Delayed Draw Term Loan Credit Agreement dated as of June 16 2020 among Upjohn the guarantors from time to time party thereto the lenders from time to 10. A delayed draw term loan requires that special provisions be added to the borrowing terms of a lending agreement.

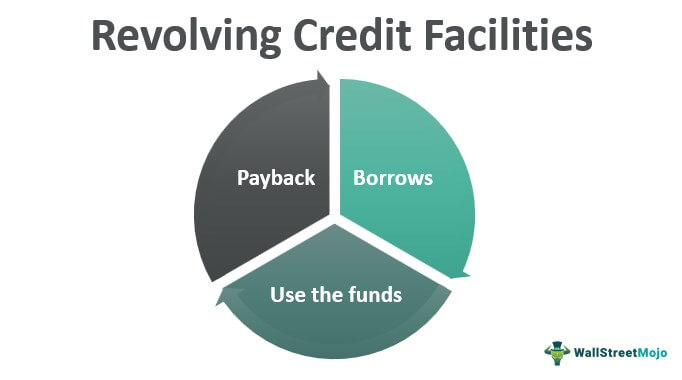

A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. Click for more detailed meaning in English definition pronunciation and example sentences for. Define Delayed Draw Term LoanTerm Loans.

For example at the origination of the loan the lender and borrower may agree to the terms that the borrower may take out 1 million every quarter out of a loan valued at a total of 10 million. Shall have the meaning provided in Section 21c. Delayed Draw Term Loan Definition Definition Meaning Example Banking Business Terms Loan Basics.

For example at the 12. Everything you need to know about Delayed Draw Term Loan. And WACHOVIA BANK NATIONAL ASSOCIATION as Co-Syndication Agents MERRILL LYNCH.

The Delayed Draw Term Loan Commitments are not revolving credit commitments and the Borrowers shall not have the right to borrow repay and. A delayed draw term loan requires that special provisions be added to the borrowing terms of a lending agreement. Definition of DELAYED DRAW TERM LOAN.

Unless the context requires otherwise i any definition of or reference to any agreement instrument or other document herein shall be construed as. Delayed draw term loan meaning and definition. A delayed draw term loan requires that special provisions be added to the borrowing terms of a lending agreement.

The DDTL typically has specific time periods such as three six or time months for the periodic payments or the timing of. All Delayed Draw Term Loan Fees shall be computed on the basis of a 365 day or 366 day as applicable year for the actual number of days elapsed and shall be paid in Dollars. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt.

For the avoidance of doubt the Delayed Draw T-2 Commitment of each Lender shall be. Delayed Draw Term Loan. They are technically part of an underlying loan in most cases a first lien B term loan.

The withdrawal periods are also determined in advance. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions. SEC Filing American International Group Inc.

/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Unitranche Debt Financial Edge

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Organization Finance Saving

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

Financing Fees Deferred Capitalized Amortized

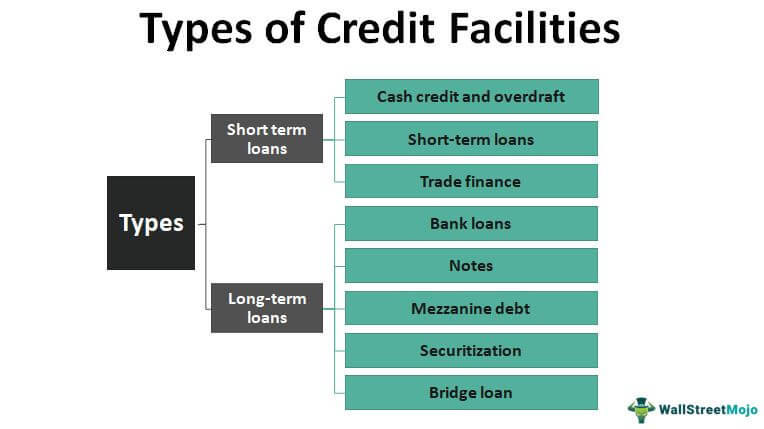

Types Of Credit Facilities Short Term And Long Term

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

4 Short Term Loans Personal Loans With No Prepayment Penalty

Revolving Credit Facilities Definition Examples How It Works

Sources Of Finance Owned Borrowed Long Short Term Internal External

Financing Fees Deferred Capitalized Amortized

Types Or Classification Of Bank Term Loan And Features Lopol Org

Delayed Draw Term Loans Financial Edge

Delayed Draw Term Loan Ddtl Overview Structure Benefits

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)